THE INSIDE ADVANTAGE SUMMER 2022

The strong leasing environment continues into the summer across most markets throughout the country. According to College House, which reports on over 1.14 million beds across 245 markets, national pre-leasing is at 90%, which is ahead YOY by 4%. The spread has understandably narrowed a bit as we approach the end of the leasing season, compared to last quarter when we were 10% ahead YOY. Current occupancy is at 87%, about 6% higher than last year. Rental rates nationally are up about 4% YOY. We are pleased to report that our owned asset portfolio is currently 92.7% pre-leased, which is up 6.1% YOY, and our projected rent growth continues to climb and now stands at 7.0% for all our owned assets.

Interest rate volatility has continued this past quarter, with the 10-year Treasury ranging from 2.75% to 3.50% and back down to 2.80% as of mid-August. After a 75 bps increase in the federal funds rate at the June meeting, the Federal Reserve again increased rates by 75 bps at the July meeting on July 26–27. The futures markets point to a smaller 50 bps increase in September and then tapering off to 25 bps for November and December. Despite the volatility, a variety of lenders remain interested in most student housing markets. Debt funds, regional banks, and life insurance companies continue to take market share away from the agencies, but FNMA in particular appears to be poised to be more aggressive over the next several months. Fixed-rate debt is more popular right now given the steepness of the forward curve of interest rate caps.

With the rise in interest rates, a bit of the froth has finally come off the market. Buyers are not pushing the envelope quite as much as they were earlier in the year, but a tremendous amount of capital is still chasing deals in core, core-plus, and value-add sectors. Both in conversations with brokers and in running IRR neutral analysis of pricing focusing on differences in cost of debt over the past several months, the implied price correction is relatively slight, approximately 2–5%.

As the leasing season draws near to a close, budgets are being prepared and rates are being debated and set for next year. Most of the groups we have talked to are encouraged by the success in most markets this year and believe there is continued strength to come, which will likely support fairly aggressive increases in rent for the 2023–24 academic year.

Scott Barton

Chief Investment Officer

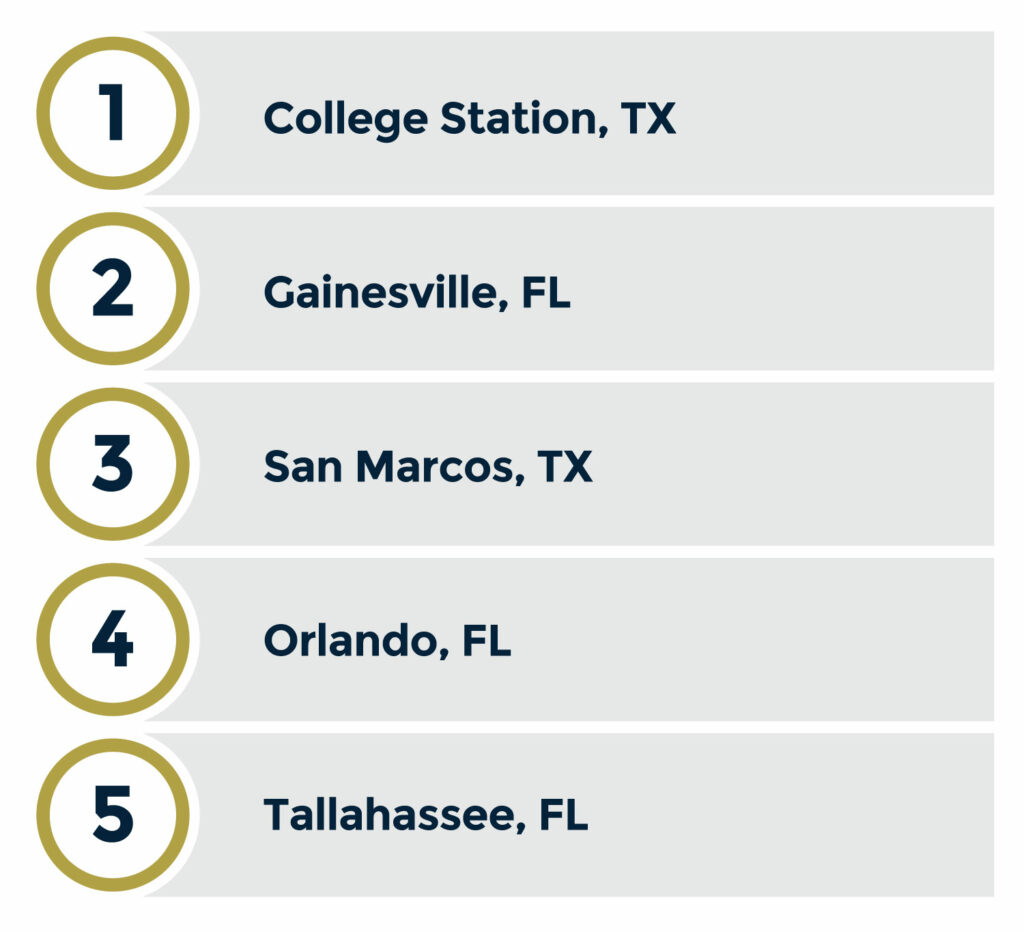

Pre-leasing has remained well ahead of last year into August 2022. This year’s pre-leasing levels compared against last year’s in all the regions have come in a bit as we approach the end of the leasing season. In addition, the variance among the regions has lessened so that now every region is between 6.4% to 8.8% ahead of last year. The top five markets with the biggest jump in YOY pre-leasing from last year are:

Catalyst, our marketing partner, worked with the Leasing and Marketing department at Campus Advantage to plan the Summer Kickoff campaign, which ran from April 11 through June 5 promoting two big giveaways and smaller weekly raffles. As the campaign ran for eight weeks, the theme was twofold and required full participation from the site teams. The larger giveaways consisted of two $1,000 travel gift cards to be used for a summer of travel and experiences. Secondly, the site teams were responsible for a minimum of one weekly raffle related to travel ($50 value maximum).

The campaign theme leveraged the trend that, after a long season of pandemic-related lockdowns and limited travel, there was an increase in the desire for travel as safety measures eased. According to Expedia’s 2022 Travel Trends Report, they declared this year will be full of travel pursuits in the GOAT category — Greatest of All Trips — that invite “transformative and meaningful travel experiences.”

Results showed the campaign was very successful as signed leases increased. Traffic was directed to custom landing pages created for each participating community via emails, Google My Business offers, website banners, emails, and SEM/SMM campaigns.

The Campus Advantage Student Housing (CASH) Fund continues to perform very well. The seed assets at the University of Florida (Lyons Corner Apartments and Lyons Corner Townhomes) have achieved a blended YTD annualized yield of 9.75%. After contemplating selling the seed assets and taking profits this summer, we decided to continue to capitalize on the strong leasing environment at the University of Florida and consider a sale next year.

We also are excited to announce the purchase of a new asset, The Stretch, at the University of Kentucky as of June 1, 2022. This is a value-add asset with physical and operational components. The Stretch is projected to meet occupancy projections and exceed effective rents for the 2022–23 academic year.

The fund will continue to purchase assets focused on value-add opportunities in Tier 1 markets with strong supply/demand dynamics.

Learn more about how Campus Advantage led a successful lease-up of Stateside in Bellingham, Washington, and established this new off-campus development near Western Washington University.Read More

Welcome to the team!

Welcome to the team!

Dena Costello

Vice President of Business Development

Dena Costello will be responsible for driving new revenue for Campus Advantage’s third-party management and consulting platforms. She will be a part of the executive leadership team and take a lead role in sourcing and developing new client relationships with investors, owners, developers, colleges, and universities to provide student housing management and consulting services while also nurturing existing client relationships. Costello brings more than 20 years of real estate industry experience to Campus Advantage. She most recently served as Director of Operations at Yugo, and completed her Bachelor of Business Administration and Management at Northeastern State University.

Tony Boetto

Real Estate Analyst

Tony Boetto will support the Investments division by providing accurate and relevant analysis and reporting for a portfolio of owned assets, and analyzing investment opportunities to determine their appropriate fit within the company’s investment objectives. Boetto most recently worked as an Investment Analyst for The Sherer Group, and completed his Bachelor of Science in Commerce with a focus in Finance from Santa Clara University.

New promotion

Nick Mobilia

Director of Investments

Nick Mobilia started with Campus Advantage a year ago as an Investment Analyst and has recently been promoted to Director of Investments. In his new role, he will be responsible for the coordination of the due diligence process, training new analysts, as well as continuing to spearhead our underwriting efforts for new acquisitions. Nick also will be an important part of the investment management process for our growing family of equity partners across all core, core-plus, and value-add real estate investments.

We have several opportunities to engage with our team of industry veterans:

Scott Barton

Investment Partnerships

Beth Pinder

Property Management Services, Consulting Services

Christy McFerren

Marketing Services

Contact us to leverage our expertise to your advantage in your student housing strategy.

Contact us