Student Housing Case Study: Moontower

Location: Austin, TX

University: University of Texas at Austin

Campus Advantage was hired in November 2018 to complete the initial lease-up of Moontower — a high-profile, new student housing development in Austin, Texas being developed by Lincoln Ventures, an Austin-based real estate investment and development firm. The 18-story, 567-bed property is located in West Campus, serving the University of Texas at Austin (UT). Catalyst, Campus Advantage’s marketing partner, was engaged to establish the brand for the asset in collaboration with Lincoln Ventures and assisted with creating digital marketing strategies to set the development apart within the competitive UT market. Numerous focus groups were held during the design phase of the development to tailor the design features to students’ preferences, and it was imperative that the brand reflected the attention to detail that was emphasized in the development plans.

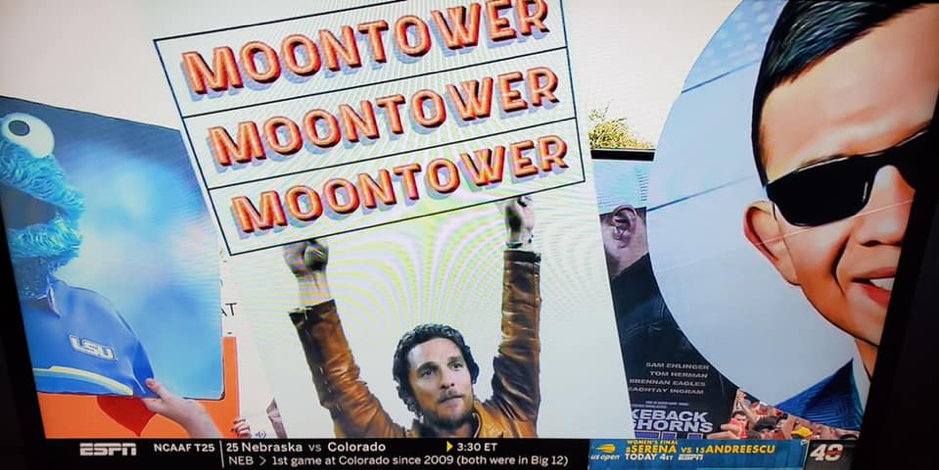

Campus Advantage and Catalyst worked together in the planning and execution of a brand that would successfully launch the development into the local community. To do so, Moontower teamed up with local businesses for social media giveaways and on-site events. The development also incorporated influential UT alumni into the branding by naming floor plans after alumni and including quotes from Matthew McConaughey, a UT alumni celebrity, in the marketing materials. Moontower’s target demographic was identified early on, and the development worked to brand and market to these students. The property emphasized guerrilla marketing efforts coupled with unique, aggressive digital strategies, including SEO, SEM, and social media meme campaigns, to drive leads for the development during the initial key leasing months. Additional marketing and leasing efforts included establishing a marketing street team, sponsoring Greek Life events, and hosting social media contests. Moontower held a philanthropy contest in May 2019 to assist in launching the brand, which resulted in more than 16,000 likes on Instagram.

Moontower has established itself as the place to be with its top-tier living experience, including an excellent location, high-end finishes, a wellness-driven amenity set, and unparalleled customer service. These combined branding and marketing efforts led to the development reaching 100% pre-lease occupancy by April 2020 — 15% ahead of the development’s direct competitors, and 27% ahead of the off-campus market.

“The strong partnership and collaboration between Lincoln Ventures and the Campus Advantage team resulted in the extremely successful first lease-up of Moontower. Building onto the positive reputation of Lincoln Venture’s prior West Campus developments, the brand and marketing strategy created by the Campus Advantage team caught the attention of all UT students, resulting in immediate demand that quickly drove leasing velocity. Leasing started 15 months before the project was scheduled to deliver, a true testament to how quality development product and integrated marketing can resonate with students. This lease-up surpassed our expectations and we are excited to continue to work alongside the Campus Advantage team to serve our Moontower residents with an unparalleled experience in the West Campus market.” – David Kanne, Founder and Managing Principal of Lincoln Ventures

Campus Advantage will continue to provide property management services after opening, which will include oversight of property operations, marketing and leasing campaigns to drive subsequent leasing seasons, and the delivery of the Students First® Experience residence life program.

About Lincoln Ventures:

Lincoln Ventures is an Austin, Texas-based real estate investment firm focused on acquiring, developing, and managing high-quality real estate in superior locations throughout the United States. They are principally engaged in the ownership, acquisition, development, and management of both residential and commercial real estate assets. They employ an opportunistic investment strategy, seeking to acquire assets that are underutilized, leveraging their teams’ unique ability to assess opportunity, innovatively design, and effectively implement a carefully crafted strategic plan. With their unique hands-on management approach, they unlock potential and create value for their assets, partners, and the surrounding community, achieving superior risk-adjusted returns.