THE INSIDE ADVANTAGE FALL 2022

The big story for the quarter involving student housing investments is interest rates, both short term and long term. The Federal Reserve has met five times so far in 2022 and raised rates each time, including 75 bps in the two meetings held in the third quarter. Another raise is anticipated in November before potentially tapering off in December and into 2023. It is hard to imagine that the federal funds rate started the year at 0.25% and now sits at 3.25% with further increases a foregone conclusion.

The federal funds rate is just the overnight rate banks pay each other, but longer-term rates have risen, as well, causing an enormous increase in borrowing costs for investors. After rising from 1.70% at the beginning of the year to 3.83% at the end of the third quarter, the 10-year Treasury kept rising to 4.22% on October 24.

If the froth came off the market during the summer in student housing, it has really put buyers on their back heels so far this fall. While fundamentals in the space remain resilient with a strong finish to the leasing year this summer and a continued follow-through into the beginning of the fall 2023 campaign, the rise in interest rates has forced buyers to lower pricing to even attempt to maintain the ultimate internal rate of return (IRR) and cash-on-cash returns they seek. With investors pumping the brakes fairly hard, there is a lack of trades in this new environment, such that no one can really say where cap rates and pricing sit with any degree of certainty. The bid-offer spread has certainly widened as sellers seek pricing from several months ago and buyers are staring the reality of fixed-rate financing above 6% square in the face.

This face-off will undoubtedly take some time to work itself out, but we believe the past performance of the student sector during recessionary environments will help it perform relative to other sectors. After the cap rate spread for student housing versus conventional multifamily widened in the second quarter from roughly flat to +40 bps (CBRE), there is evidence it may converge once more. National Multifamily Housing Council (NMHC) figures show that rent growth for conventional multifamily has tapered off from a high of more than 15% nationally in March to 11% in August. Student rent growth has tapered much less, ending the recent leasing season at 4.1% nationally (College House). We are pleased to report the Campus Advantage portfolio of assets ended the year at 8.3% effective rent growth. For those properties that have started pre-leasing for fall 2023, College House also reports that pre-leasing sits at a solid 23% nationally as of October 24. Campus Advantage is slightly behind at 19% as we believe there will be strong rent growth available again during the remainder of this leasing season.

Interest rate headwinds will likely continue to be a problem for all sectors into 2023, but for investors looking at alternative real estate investments, we like the potential for student housing to outperform for the near term.

Scott Barton

Chief Investment Officer

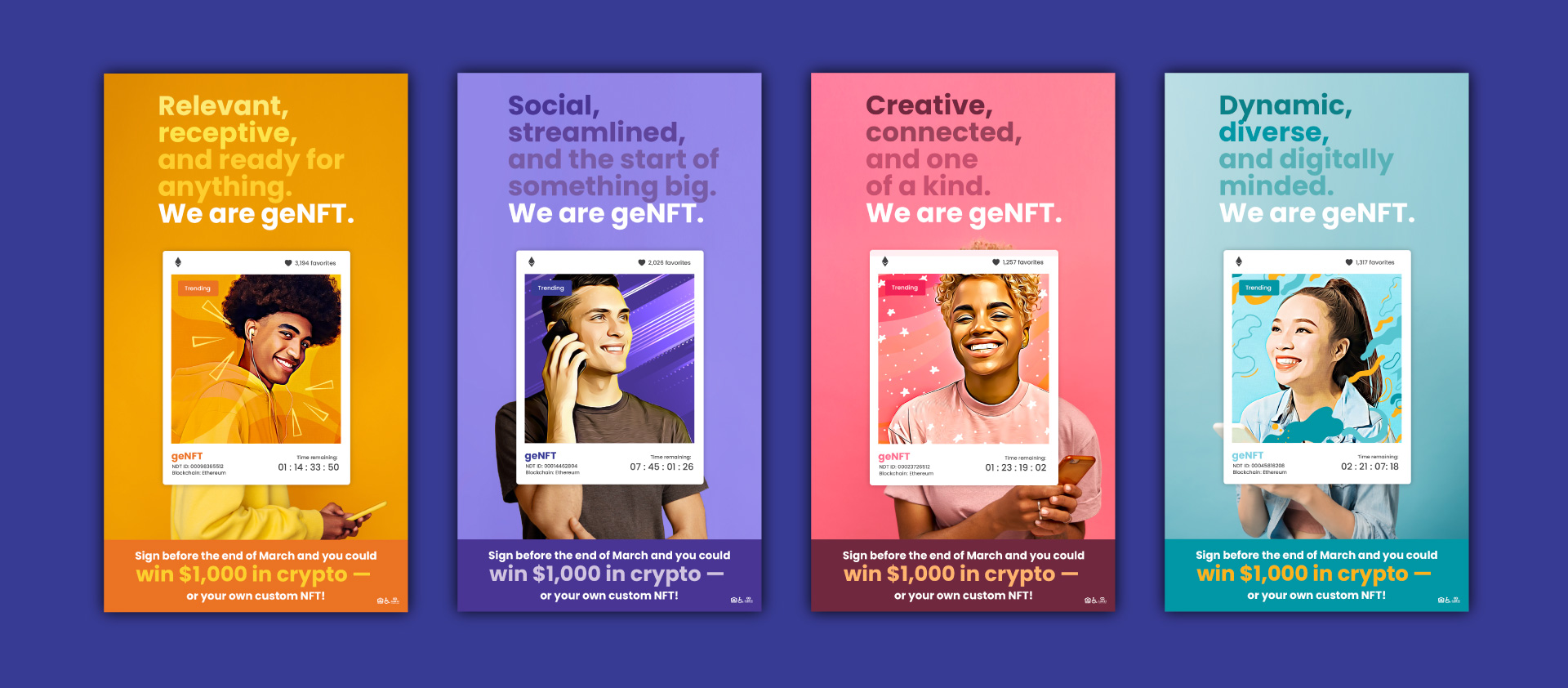

Catalyst, our marketing partner, collaborated with the Leasing and Marketing department at Campus Advantage to create a future-focused campaign called “GenFT” for our student housing properties across the United States. The theme was geared around the emerging technology of NFTs (supplemented by the growing buzz of cryptocurrency and virtual reality) as well as the innovative young adults leading the charge into this space.

Visuals and messaging spoke to Campus Advantage’s efforts to empower our residents not only as students, but as leaders, innovators, and world changers, which naturally incorporates our tagline — “The Future Lives Here.”

In addition to a landing page for each community, Catalyst created custom social media feed and story graphics, paid Facebook and Instagram ads, Google ads, emails, a video, and an editable flyer to allow each property to promote the campaign and giveaways throughout March. Residents and prospects were encouraged to tour or sign before the end of the month to take advantage of unique prizes, such as $1,000 in crypto, an Oculus Quest 2 headset, or the chance to collaborate with Catalyst and Campus Advantage to create their own custom NFT art.

The 2022 GenFT campaign was a success, driving leads and traffic to all of the participating properties in our portfolio. Highlights include:

- 1,026 new leads and renewals

- 6,071 sessions to the landing pages

- SMM campaign: 966,016 impressions and 6,921 clicks

- SEM campaign: 384,354 impressions and 6,312 clicks

The strong performance of the Campus Advantage Student Housing (CASH) Fund continues. The seed assets at the University of Florida (Lyons Corner Apartments and Lyons Corner Townhomes) achieved a combined rent growth of 5.9% into the 2022–2023 academic year. This compares to the national figure of 4.1% previously mentioned.

We closed on The Stretch at the University of Kentucky on June 1, 2022, so we did not have much time to affect occupancy and rent growth for the remainder of the leasing season. However, in a short period of time, the CA team went to work and moved the needle on both occupancy and rent growth. At the time of purchase, pre-lease occupancy was 64% and rent growth was projected at 2.04%. We ended the leasing season at 94% occupancy and 4.68% rent growth. It is difficult to move occupancy a great deal without sacrificing rate, so we are very pleased that we were able to significantly improve both and ended up ahead of our pro forma projections.

All indications are for another strong year of leasing and rent growth potential in most major markets in the country. The increase in interest rates has made the investment market fairly disjointed, and many buyers are on the sidelines. While we will be prudent investors, we think the opportunity will exist to purchase quality assets with less competition during this period of upheaval.

Learn more about how Campus Advantage’s third-party management services have successfully guided the lease-up of Arcadia on the River in Milledgeville, Georgia, serving Georgia College and State University and Georgia Military College.

Read More

The July/August issue of Student Housing Business featured a few voices from Campus Advantage and Catalyst, including:

Dena Costello, Vice President of Business Development and Client Services

Beth Pinder, Chief Operating Officer

Christy McFerren, President of Catalyst

We have several opportunities to engage with our team of industry veterans:

Scott Barton

Investment Partnerships

Beth Pinder

Property Management Services, Consulting Services

Christy McFerren

Marketing Services

Contact us to leverage our expertise to your advantage in your student housing strategy.

Contact us